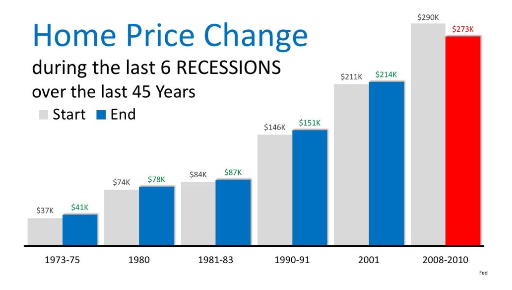

The market has had a historic run since 2009, but at some point it will have to slow down or take a dip. How will this impact the housing market? No one can predict the future, but we can look at the past for some answers. Over the last six recessions since 1973, housing prices actually went up during five of those six recessions. The 2008 recession was different in that it was partially set off by the real estate bubble popping. Easy money led to out of control speculation and unrealistic demand for housing by investors who ultimately could not afford to make the payments on the mortgages.

Today, money is not as easy to come by. As evidenced below, lending standards measured by the Mortgage Credit Availability Index were extremely high from 2004-2007. Stated income and stated assets were the norm. Rarely did anyone have to actually document the ability to repay the loans they were committing to.

The lending standards today remain far below the normal standard which is between 400-450 on the index above. As a result, foreclosures are currently near record lows and about 62% less than where they were at in 2003 before the real estate money became so easy to obtain.

Now you have to fully document income and assets to go along with tighter credit standards in order to get approved for a mortgage. This means the real estate market is on a much stronger footing which will serve it well in any future recessions. Now is still a good time to buy or build a house in most markets, or renovate an existing home. Please reach out to me if you have any real estate financing questions.